THE INCOME SHEET - Importing Data

Importing Data into QuickBAS

- QuickBAS lets you import bank data or other accounting data without manually typing each entry.

- QuickBAS accepts Comma Separated Values (csv) and Tab Separated Values (tsv) file.

- First export your data from your bank website as CSV or TSV files

- Save that CSV/TSV file to your computer

- Note that this is very powerful feature, and should be used with caution!

- QuickBAS lets you import bank data or other accounting data without manually typing each entry.

- QuickBAS accepts Comma Separated Values (csv) and Tab Separated Values (tsv) file.

- First export your data from your bank website as CSV or TSV files

- Save that CSV/TSV file to your computer

- Note that this is very powerful feature, and should be used with caution!

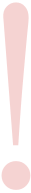

How to access the import function

- You can import into the Income and Expense sheets only.

- In the top menu, choose File --> Import Data

- An 'Import Wizard' page appears that will guide you through the import data process.

Data Requirements.

- You must choose a valid csv or tsv file

- These files can have a .csv or .tsv or just a .txt file extension

- QuickBAS does not import OFX, QIF or Quicken files.

- You can import into the Income and Expense sheets only.

- In the top menu, choose File --> Import Data

- An 'Import Wizard' page appears that will guide you through the import data process.

Data Requirements.

- You must choose a valid csv or tsv file

- These files can have a .csv or .tsv or just a .txt file extension

- QuickBAS does not import OFX, QIF or Quicken files.

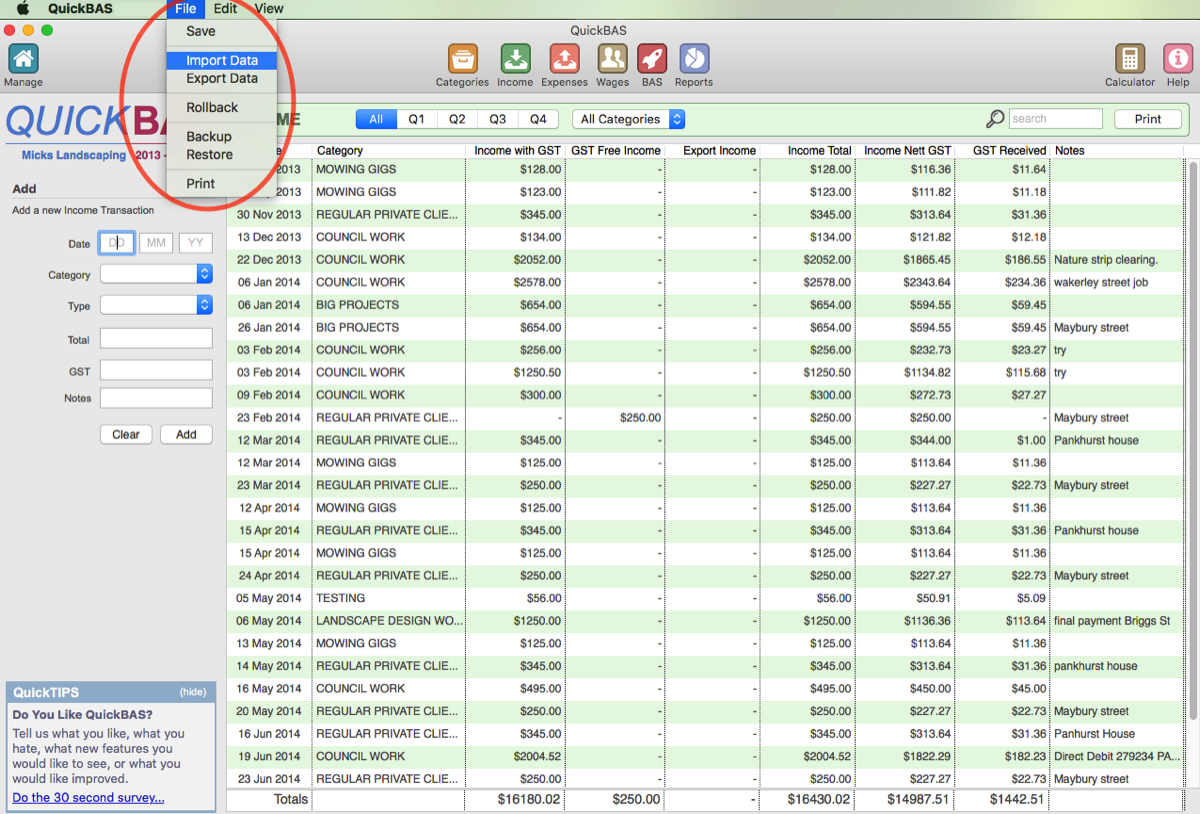

How to specify columns

- Click on the column heading to specify data type

- You must specify which column contains the date and transaction amount

- You can optionally include a column containing GST and extra Notes

- Click on the column heading to specify data type

- You must specify which column contains the date and transaction amount

- You can optionally include a column containing GST and extra Notes

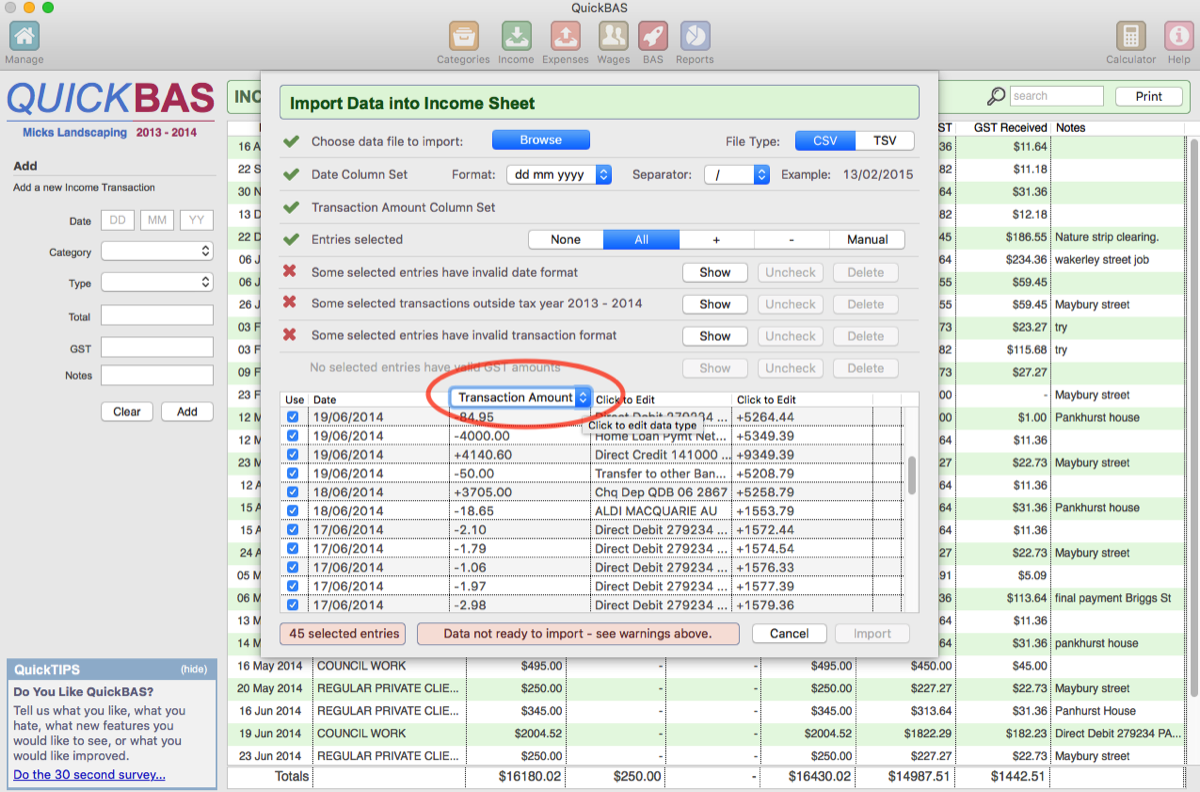

Which rows of data will be included in my import?

- Only those rows with a ticked box in column 1 will be included.

- You can use the selector to choose rows (none, all, positive values, negative values)

- Or you can manually tick entries to fine-tune your selection

- Only those rows with a ticked box in column 1 will be included.

- You can use the selector to choose rows (none, all, positive values, negative values)

- Or you can manually tick entries to fine-tune your selection

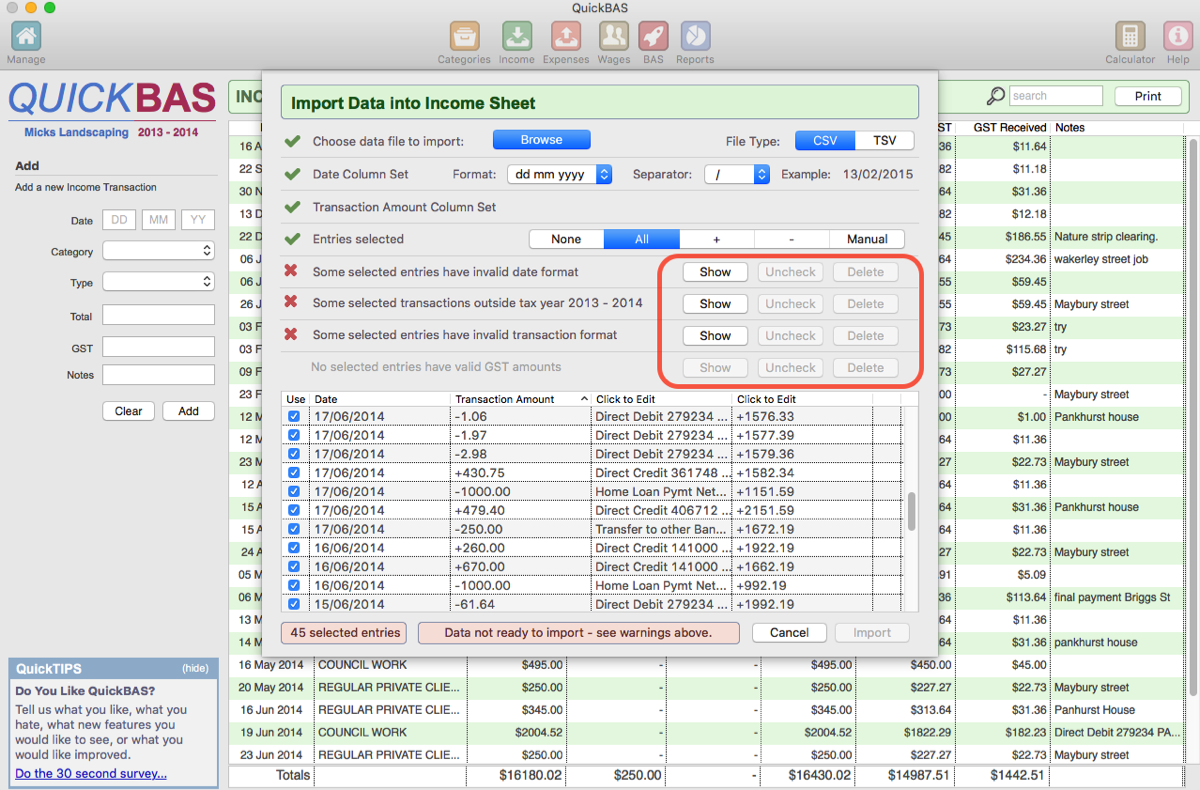

Making sure all data is valid

- Every rows of data that is ticked must have valid data

- The Import Wizard will warn you if rows of data have invalid values

- You can use the buttons to automatically Show, Uncheck or Delete invalid rows

- Use the Date formatting area to match the date format, including the separator

- All ticked dates must be in the tax year you are working on

- All Transaction Amounts must be numerical values

- Setting a GST column is optional. QuickBAS will calculate GST values if you don’t

- If you set a GST column, all values must be numeric

- GST amounts must be less that the total Transaction amount

- Only when all rows have valid data will the Import button show

- Every rows of data that is ticked must have valid data

- The Import Wizard will warn you if rows of data have invalid values

- You can use the buttons to automatically Show, Uncheck or Delete invalid rows

- Use the Date formatting area to match the date format, including the separator

- All ticked dates must be in the tax year you are working on

- All Transaction Amounts must be numerical values

- Setting a GST column is optional. QuickBAS will calculate GST values if you don’t

- If you set a GST column, all values must be numeric

- GST amounts must be less that the total Transaction amount

- Only when all rows have valid data will the Import button show

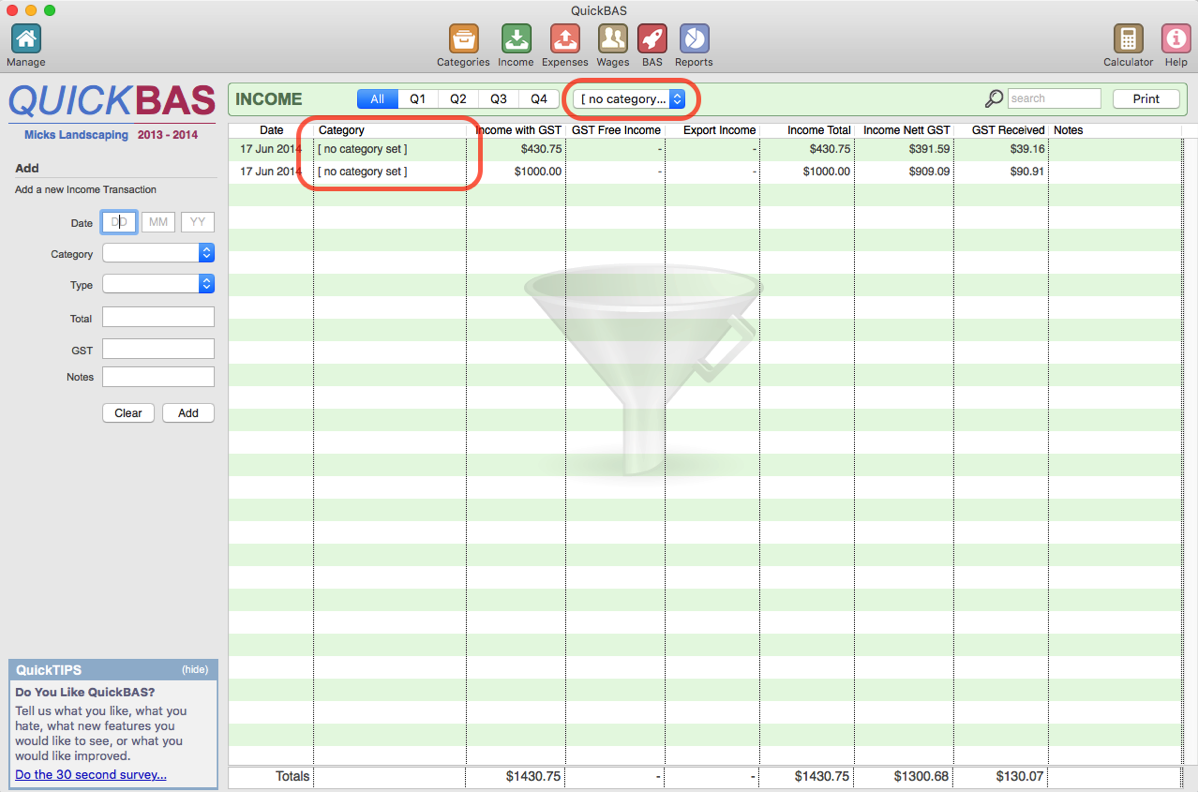

Am I finished when I have imported?

- The newly imported entries will not be set with Categories or Income/Expense types.

- All newly imported data is put into a placeholder category called '[ no category set ]'.

- QuickBAS will show you a filtered view of all the newly imported data.

- You need to click each entry and edit the Category, and the Income or Expense Type

- You can also batch edit a group of transactions, and choose a new Category for them

- The newly imported entries will not be set with Categories or Income/Expense types.

- All newly imported data is put into a placeholder category called '[ no category set ]'.

- QuickBAS will show you a filtered view of all the newly imported data.

- You need to click each entry and edit the Category, and the Income or Expense Type

- You can also batch edit a group of transactions, and choose a new Category for them

QuickBAS User Guide - Importing Income Data