What does QuickBAS do?

QuickBAS is an accounting app that helps small Australian businesses fulfil all their Business Activity Statement obligations. Using QuickBAS, businesses can enter their income and expense transactions, any wages and tax withheld, and generate a BAS for any quarter. QuickBAS provides an annual summary of income, expenses and wages to help with annual tax returns. QuickBAS is ideal for small businesses, especially sole traders, who are happy doing their accounts themselves. QuickBAS is designed for ease of use, and rocket-fast results.

What platforms does QuickBAS work on?

QuickBAS works on Apple Mac, and PC desktop platforms. QuickBAS does not work on iPhone or iPad.

What doesn’t QuickBAS do?

QuickBAS does not do invoices.

QuickBAS does not do payroll.

QuickBAS does not do monthly Activity Statements, only quarterly.

QuickBAS is for preparation of your BAS, but does not submit your BAS online.

QuickBAS does not do payroll.

QuickBAS does not do monthly Activity Statements, only quarterly.

QuickBAS is for preparation of your BAS, but does not submit your BAS online.

Does QuickBAS do Wages and PAYG Tax Withholding?

Yes. QuickBAS has a whole section for Wages and tax withheld, for those businesses with employees or suppliers. QuickBAS lets you specify employees, wages and any taxes withheld from payments, and then your BAS Withholding section is completed automatically. A Wages summary is provided in the Reports.

Note that QuickBAS is not a Payroll program.

Note that QuickBAS is not a Payroll program.

Does QuickBAS do GST instalments and Variations, PAYG Income Tax Instalments, Wine Equalisation Tax, Fringe Benefits Tax, Luxury Car Tax and Deferred Company Instalments?

Yes. For those businesses that have these tax obligations, QuickBAS allows you to add these amounts and will be included in your BAS.

Does QuickBAS do Fuel Tax Credits?

Yes. QuickBAS does not calculate the Fuel Tax Credit, but once you know your credit amount, you can enter that amount into QuickBAS, and it will be included in your BAS.

Can I print out the BAS that QuickBAS generates and post it to the ATO?

No. QuickBAS provides all the data required to fill out your BAS, but you must transfer those values to the printed form provided to you by the ATO.

Does QuickBAS submit the BAS to the ATO online?

No. QuickBAS helps you prepare your BAS, but you must transfer the values to the paper BAS form or your own online submission facility.

Where is my data stored? Is it secure?

QuickBAS stores all its data in a database on your own computer’s hard drive, and only you have access to the data. It does not store any data online or in the cloud. In fact, once you purchase and register, you can use QuickBAS completely offline.

What is the difference between the trial version and the full version of QuickBAS?

The trial version is provided as a free download to let users test if the software is suitable for their business needs. It is limited to 10 income and 10 expense transactions. By purchasing a licence, you can unlock QuickBAS to the full version, which handles unlimited income and expense transactions for an unlimited number of business names and tax years.

How do I purchase an Activation Licence?

Go to our Download page and click on the QuickBAS Licence button at the bottom of the page. You have two options for payment:

- Paypal: you can use any credit card (no need for a Paypal account) or your Paypal account

- Direct Order: you will be emailed bank details for direct deposit and postal address if you wish to pay via cheque.

Note that paying via credit card and Paypal will get you your licence instantly via email, while paying by direct deposit or cheque means the licence is delayed until funds clear.

- Paypal: you can use any credit card (no need for a Paypal account) or your Paypal account

- Direct Order: you will be emailed bank details for direct deposit and postal address if you wish to pay via cheque.

Note that paying via credit card and Paypal will get you your licence instantly via email, while paying by direct deposit or cheque means the licence is delayed until funds clear.

I have purchased a QuickBAS licence, but it has not arrived. Where is it?

Licences are emailed within minutes of payment being made. If it does not appear in your Inbox, please check your SPAM or Junk mail folder. Some email clients send automated emails like this to the Spam folder by default. If you find it in the Spam folder, please tag it as “Not Spam” to avoid future emails from QuickBAS going to Spam. If it is not in your inbox or your Spam folders, please use the Contact Us page for support.

If you purchased via Direct Bank Deposit or cheque, funds must clear before a licence is sent. This usually takes 1-3 business days.

If you purchased via Direct Bank Deposit or cheque, funds must clear before a licence is sent. This usually takes 1-3 business days.

I have purchased a QuickBAS licence. How do I activate QuickBAS?

You will be sent a unique licence code via email.

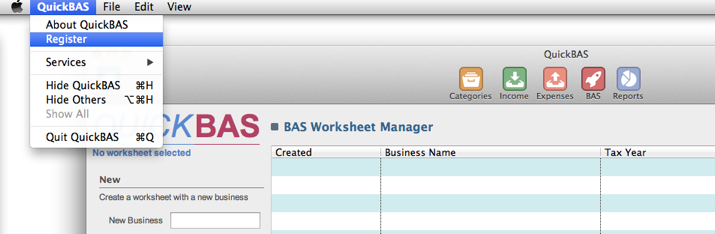

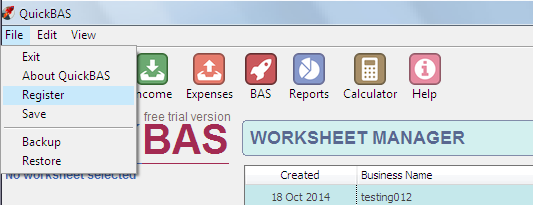

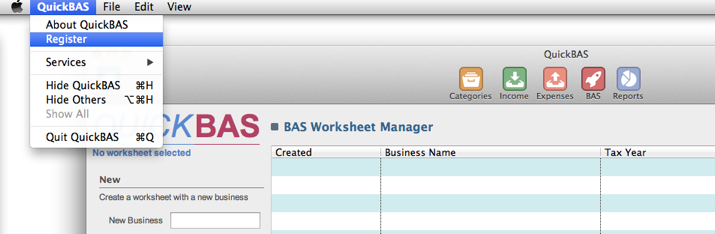

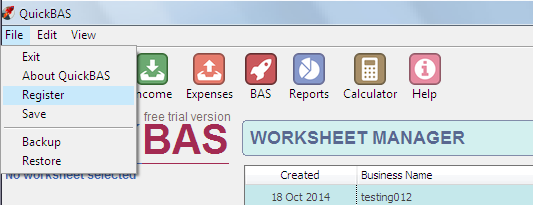

To use your activation code, fire up QuickBAS, and use the “Register” option in the top menu.

On a Mac, the Register option is under the QuickBAS menu item.

On Windows, the Register option is under the File menu

The activation code is linked to your name and email address you used to purchase the licence, so be sure to enter the correct details.

If you need any support, contact us.

To use your activation code, fire up QuickBAS, and use the “Register” option in the top menu.

On a Mac, the Register option is under the QuickBAS menu item.

On Windows, the Register option is under the File menu

The activation code is linked to your name and email address you used to purchase the licence, so be sure to enter the correct details.

If you need any support, contact us.

How can I transfer QuickBAS to a new computer?

You can transfer all your QuickBAS data including your licence using our Backup and Restore technique. Read more here.

What are the system requirements for QuickBAS?

QuickBAS will work an almost any Mac or Windows computer. Mac users must be running OS 10.7 or above. Windows users must be using Vista, Windows 7, Windows 8 or Windows 10. The screen resolution must be at least 1200 x 768 pixels. An active internet connection is required for activating a QuickBAS licence, but may then be used offline. QuickBAS is now a 64 bit app, and requires a 64 bit operating system to run. Almost all computers nowadays are 64 bit compatible.

Windows XP is no longer supported.

Windows XP is no longer supported.

What is the QuickBAS refund policy?

QuickBAS is available as a free trial version so you can test if it works on your system, as well testing if it is suitable for your business. We expect that you will purchase an activation licence only if you are satisfied with its function and suitability. The QuickBAS licence cost is non-refundable if you simply change your mind. Refunds will be given if you can demonstrate that QuickBAS contains errors, bugs, omissions apart from those listed above, and that they significantly negatively impact on your use of the software.

QuickBAS - BAS Statement Software FAQs