The BAS Sheet - Setting BAS Extras

Business Activity Statement extras

- The Business Activity Statement is a regular report of your business financial standing

- The Income and Expense sheets help you calculate your GST requirements

- The Wages Sheet helps you calculate your Wages and Withholding

- Some businesses have extra reporting requirements, as explained below

- These extra values are quarterly

- These extra options will only appear if you have chosen a quarter on the BAS Sheet

- The Business Activity Statement is a regular report of your business financial standing

- The Income and Expense sheets help you calculate your GST requirements

- The Wages Sheet helps you calculate your Wages and Withholding

- Some businesses have extra reporting requirements, as explained below

- These extra values are quarterly

- These extra options will only appear if you have chosen a quarter on the BAS Sheet

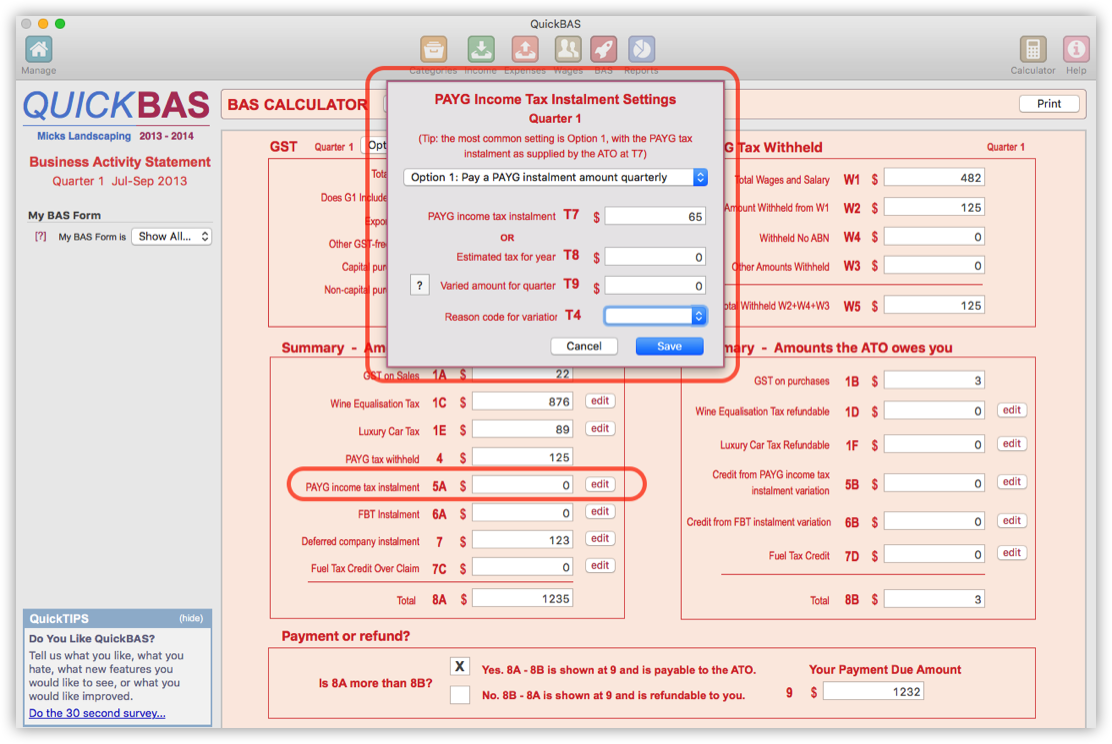

PAYG Income Tax Instalment

- The most common extra is PAYG Income Tax Instalment

- PAYG Income Tax Instalment is your business’ quarterly income (not GST) tax

- PAYG Income Tax Instalment is usually supplied by the ATO

- Click the “Edit” button next to the 5A field

- A pop-up box appears with various PAYG Income Tax Instalment options

- Enter your PAYG Income Tax Instalment, as supplied by the ATO

- Alternatively you can choose to vary the amount you pay

- Please refer to the ATO or your accountant for more information about varying

- Click “Save” to store the amount for this quarter

- The most common extra is PAYG Income Tax Instalment

- PAYG Income Tax Instalment is your business’ quarterly income (not GST) tax

- PAYG Income Tax Instalment is usually supplied by the ATO

- Click the “Edit” button next to the 5A field

- A pop-up box appears with various PAYG Income Tax Instalment options

- Enter your PAYG Income Tax Instalment, as supplied by the ATO

- Alternatively you can choose to vary the amount you pay

- Please refer to the ATO or your accountant for more information about varying

- Click “Save” to store the amount for this quarter

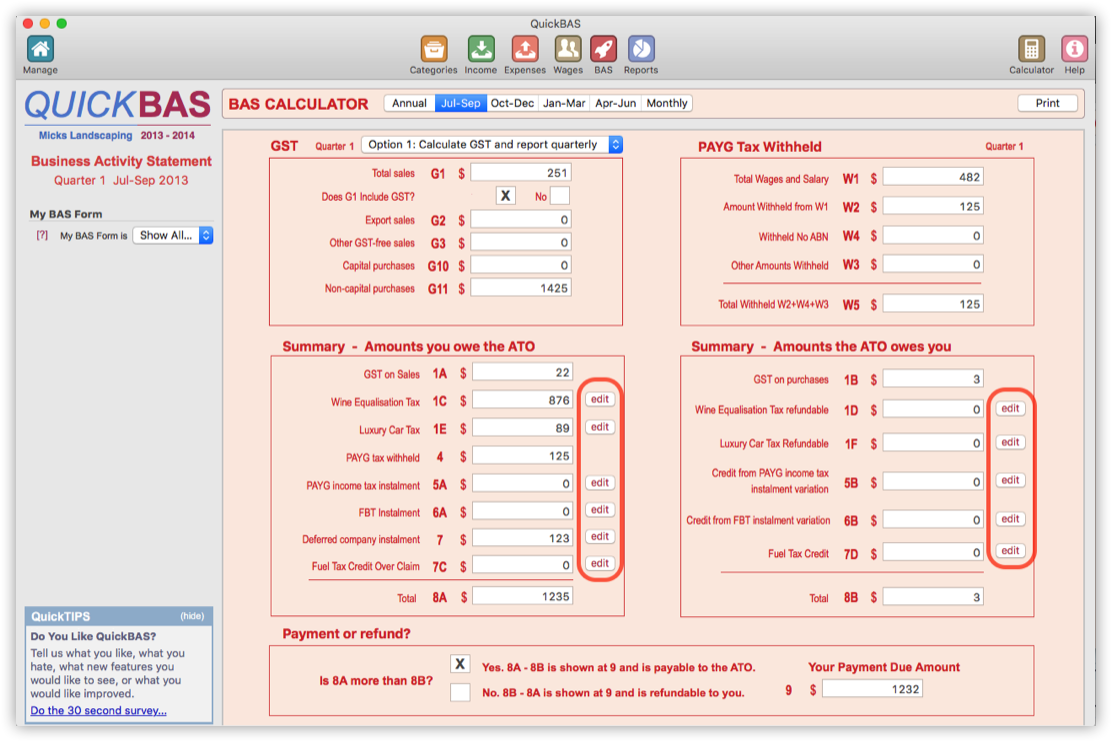

Other Extras

- PAYG Tax Withheld is the tax you withheld from your employees

- PAYG Tax Withheld is calculated from the Wages sheet, and is not editable

- Less common extras are Luxury Car Tax, FBT instalments, Wine Equalisation Tax etc

- If your business has these extra reporting requirements, add them on the BAS sheet

- Use the buttons to the right of each value field, click “Edit”, enter a value, click “Save”

- QuickBAS will store these values for the quarter

- PAYG Tax Withheld is the tax you withheld from your employees

- PAYG Tax Withheld is calculated from the Wages sheet, and is not editable

- Less common extras are Luxury Car Tax, FBT instalments, Wine Equalisation Tax etc

- If your business has these extra reporting requirements, add them on the BAS sheet

- Use the buttons to the right of each value field, click “Edit”, enter a value, click “Save”

- QuickBAS will store these values for the quarter

QuickBAS User Guide -Setting BAS Extras